Assume Purchase Costs Are Rising Determinee Which of the Following

June 1 at 10 June 2 at 15 July 4 at 20 The company sells two units during the period. Companies using LIFO will report the smallest cost of goods sold.

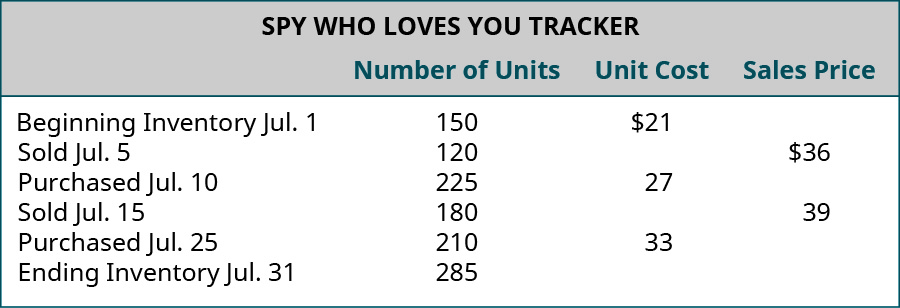

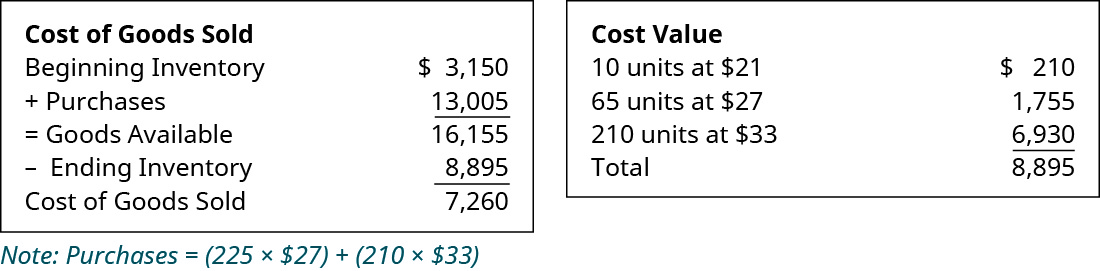

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

Given the following information determine the cost of goods sold for the period.

. Assume the following facts. During the period it sold 4 units from beginning inventory 8 units from the Jan. During a period of regularly rising purchase costs this method yields the highest reported cost of goods sold amount on the income statement.

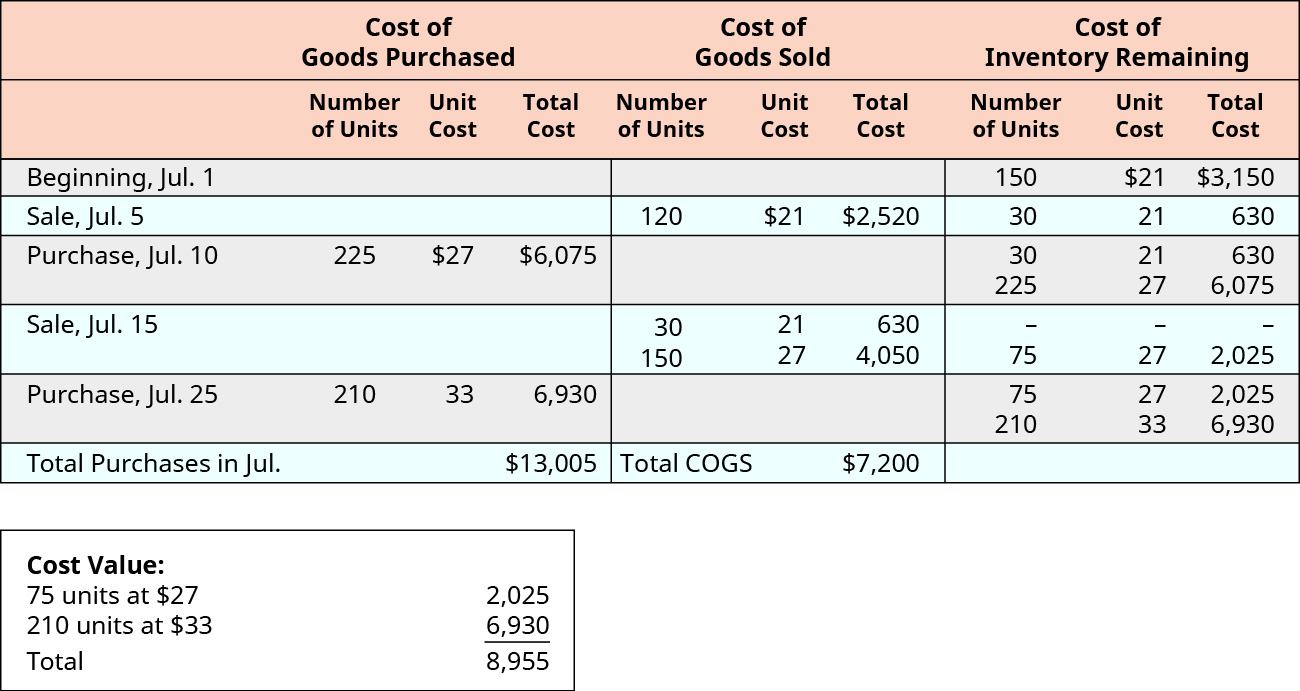

Cost of goods sold was calculated to be 7200 which should be recorded as an expense. With the lower for longer interest rate environment and rising costs of technology investments we believe already rising US. LIFO Last-In First-Out is one method of inventory used to determine the cost of inventory for the cost of goods sold calculation.

By removing these weaker plants the stronger lettuce plants have more room to grow. If current costs were used to value inventory beginning inventory would have been 23000000 and ending inventory would have been 26700000. Units sold at Activities Units Acquired at Cost 140 units 600 Retail Date 1 Beginning inventory 840 Jan 100 units 15 Jan.

Assume that Widgets Inc. 5 purchase and 2 units from the Jan. Assume that Widgets Inc.

The company uses a perpetual inventory system. Determine what cost of goods sold would be if Ulysses used FIFO. I Specific Identification Available for Sale Cost of Goods Sold Purchase Date Activity Units Unit Cost Units Solil Unit Cost COGS 600 I 500 275 J025 Jan.

Assuming purchase costs are rising in a periodic. Uses a perpetual specific identification inventory system. M Read about this.

Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. 1 Beginning Inventory 140 6001 125i. For specific identification ending inventory consists of 300 units from the January 30 purchase 5 units from the January 20 purchase and 25 units from beginning inventory.

Jan 1 Beginning Inventory 950 Jan 1-30. Of the units sold 14 are from the December 7 purchase and 14 are from the December 14 purchase. The inventory at period end should be 8955 requiring an entry to increase merchandise inventory by 5895.

It reported beginning inventory of 20000000 and ending inventory of 24500000. 10 Sales 60 units 500 300 Jan. During the period it sold 4 units from.

The Company uses a perpetual inventory system. Enter the email address you signed up with and well email you a reset link. Uses a perpetual specific identification inventory system.

Assuming purchase costs are rising in a periodic inventory system determine which of the statements below are correct regarding the cost of goods sold under FIFO LIFO and weighted average cost flow methods. Monson uses a perpetual inventory system. 5 are from the January 20 purchase inventory al inventory system.

LIFO valuation considers the last items in inventory are sold first as opposed to LIFO which considers the first inventory items being sold first. Assume that three identical units are purchased separately on the following three dates and at the respective costs. Assume that Widgets Inc.

Demonstrate the journal entry required the sale and the cost of the sale by selecting all of the correct items below Jan 1 Beginning Inventory 10 12 Jan 5 Purchase 10 15 Jan 30 Purchase 10 18 Feb 8 Sale 17 fish. Business Accounting QA Library The following information applies to the questions displayed below Laker Company reported the following January purchases and sales data for its only product. Determine the cost assigned to ending inventory and to cost of good using aspecific identification b weighted average c FIFO and d LIFO round per units costs and inventory amounts to cents.

Cost of goods sold using LIFO was 34900000. Assuming purchase costs are rising determine which of the statements below are correct regarding the cost of goods sold under FIFO LIFO and weighted average cost flow methods. Requirement Perform a cost-benefit analysis for the first year of implementation to determine whether the Hired would be a financially viable investment if the minimum wage is raised to 13 per hour.

20 Purchase 110 units. 1 Beginning inventory 165 units 900 1485 Jan. Check all that apply Check all that apply.

For specific identification ending inventory consists of 280 units where 260 are from the January 30 purchase. This means that income taxes paid will be lower lowerhigher than if the company used FIFO or weighted average inventory costing. Date Activities Units Acquired at Cost Units sold at Retail Jan.

Your answer is correct. Financials MA activity particularly within the smallmid-cap space is likely to continue to accelerate. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification.

Yield curve recent steepening aids sentiment with possibility of higher net interest incomemargins. Many companies choose to use LIFO inventory costing during periods of rising purchase costs because reported cost of goods sold will be highest lowesVhighest. 30 Purchase 260 units 900 2340 Totals 550 units - 5275 270 units The Company uses a perpetual inventory system.

Monson sells 28 units for 10 each on December 15. Companies using FIFO will pay higher taxes than companies using. For specific identification ending inventory consists of 200 units where 180 are from the January 30 purchase 5 are from the January 20 purchase and 15 are from beginning inventory.

Laker Company reported the following January purchases and sales data for its only product. Required information The following information applies to the questions displayed below Laker Company reported the following January purchases and sales data for its only product. Laker company reported the following January purchases and sales data for its only product.

10 Sales 125 units 1800 Jan. Journal entries are not shown but the following calculations provide the information that would be used in recording the necessary journal entries. Determine the costs assigned to the December 31 ending inventory when costs are assigned based on specific identification.

Given the following information determine the cost of goods sold for the period. LIFO During a period of regularly rising purchase costs this method yields the lowest income tax expense. If you want to use LIFO you must elect this method using IRS.

Uses a perpetual FIFO inventory system During the period it sold 12 units on credit to one customer. This problem has been solved.

Paper Towns Figurative Language Figurative Language Poetry Examples Similes And Metaphors

Inventory And Cost Of Goods Sold Quiz And Test Accountingcoach

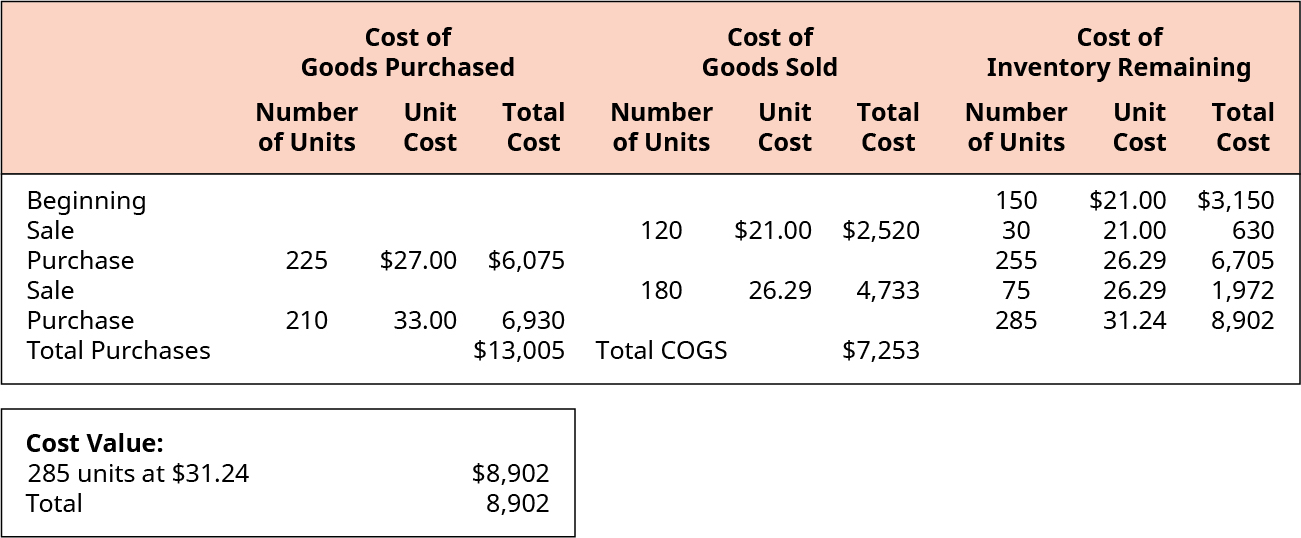

Calculate The Cost Of Goods Sold And Ending Inventory Using The Perpetual Method Principles Of Accounting Volume 1 Financial Accounting

Weighted Average Cost Accounting Inventory Valuation Method

Calculate The Cost Of Goods Sold And Ending Inventory Using The Perpetual Method Principles Of Accounting Volume 1 Financial Accounting

What Is The Fifo Method Calculations Examples Impact Quickbooks

Perpetual Fifo Lifo Average Accountingcoach

Renting Want To Own Your Own Home Do You Know How Big Of Mortgage You Could Get For What You Are Currently Paying Conventional Mortgage Mortgage Home Buying

/dotdash_Final_How_is_a_Cost_of_Living_Index_Calculated_Oct_2020-01-f5552b1a61f44bc38cf63bee4f1b67b0.jpg)

How Is A Cost Of Living Index Calculated

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

:max_bytes(150000):strip_icc()/ready-to-buy-house.asp_final-b6fe5f59254146af84917febd47b0a14.png)

Buying A House What Factors To Consider

Inventory And Cost Of Goods Sold Quiz And Test Accountingcoach

/MinimumEfficientScaleMES2-c9372fffba0a4a1ab4ab0175600afdb6.png)

Minimum Efficient Scale Mes Definition

Ending Inventory Formula Step By Step Calculation Examples

What Is The Weighted Average Cost Method Explained

/diseconomies_of_scale_final-db85c494049d42aca10deb37e214a013.png)

Diseconomies Of Scale Definition

What Is The Fifo Method Calculations Examples Impact Quickbooks

/dotdash_Final_How_is_a_Cost_of_Living_Index_Calculated_Oct_2020-01-f5552b1a61f44bc38cf63bee4f1b67b0.jpg)

How Is A Cost Of Living Index Calculated

How To Make Eoq Relevant Again Supply And Demand Chain Executive

Comments

Post a Comment